Do You Use Health Insurance for Physical Therapy – A Deep Dive into Coverage, Costs, and Care!

Physical therapy is essential for recovering from injuries, surgeries, or managing chronic pain. But many patients wonder—can you use health insurance for physical therapy? The answer is usually yes, but coverage depends on your insurance plan.

Most health insurance providers in the U.S., including private plans, Medicare, and Medicaid, offer some level of coverage for physical therapy. However, your benefits can vary based on the type of plan, your diagnosis, and whether the therapy is deemed “medically necessary.”

Understanding Health Insurance and Physical Therapy Coverage

Health insurance is designed to help you manage the costs of medical services, including preventive care, emergency care, and rehabilitative treatments like physical therapy. Most insurance plans in the United States—whether employer-sponsored, private, or government-funded—offer some level of coverage for physical therapy. However, the specifics of what’s covered and how much you’ll need to pay out of pocket vary widely depending on your plan.

Generally, physical therapy is classified under “rehabilitative services” or “outpatient care” in health insurance policies. This means the care is considered medically necessary if it helps you recover from surgery, injury, or illness. To ensure coverage, your insurance provider may require a doctor’s referral, prior authorization, or proof that the treatment is essential for your recovery.

How Insurance Coverage for Physical Therapy Typically Works?

When your doctor prescribes physical therapy, first check if the clinic accepts your insurance. Even with coverage, you may only get full benefits with in-network providers; out-of-network visits can be costlier or denied.

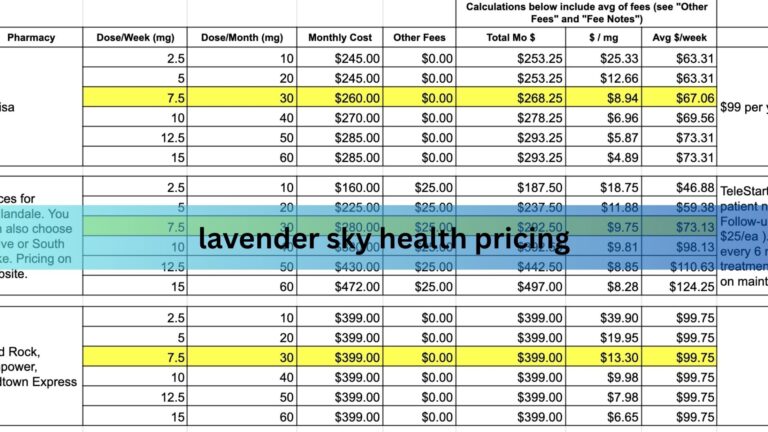

If covered, you’ll likely pay part of the cost via a copay (e.g., $20–$50 per session), coinsurance (a percentage of the session cost), or meet a deductible before coverage starts. Also, check if your plan limits yearly sessions—many cap at 20–30 visits, with extra sessions requiring approval or out-of-pocket payment.

Types of Insurance and How They Handle Physical Therapy:

Private Health Insurance

Often includes physical therapy but requires a doctor’s referral. In-network therapists are cheaper; out-of-network may cost more or be denied. Co-pays and annual visit limits (e.g., 20) are common.

Medicare

Covers outpatient physical therapy under Part B if medically necessary. After meeting the deductible, Medicare pays 80%, and the patient covers 20% unless they have supplemental insurance. Annual caps apply but can be waived.

Medicaid

Coverage varies by state. Pediatric therapy is generally well-covered, but adult coverage depends on state rules. Pre-authorization may be required.

Workers’ Compensation

Covers therapy for job-related injuries if approved by the employer’s insurer. No out-of-pocket cost, but care must be from authorized providers.

Auto Insurance (PIP)

Covers therapy for accident-related injuries in states with PIP. Pays regardless of fault. Coverage limits depend on state laws and policy terms.

VA Insurance

Veterans get therapy through VA medical centers or community care. Coverage is generally full with little or no copay, depending on eligibility.

Also Read: Haven Health Phoenix – Comprehensive Skilled Nursing & Rehabilitation!

Tricare

Covers therapy for active-duty military and families with a referral. Benefits vary by plan (Prime, Select, etc.), and prior authorization may be needed.

Short-Term Health Insurance

Offers limited or no therapy coverage. If included, only a few sessions may be covered. High deductibles are typical.

Health Sharing Plans

Not traditional insurance. May offer partial reimbursement for therapy, but members often pay upfront. Coverage varies by group guidelines.

Employer Self-Insured Plans

Employer-funded plans may offer broader therapy benefits. Still require referrals and may have visit limits, but often more flexible than standard plans.

What Happens If You Don’t Have Insurance?

If you don’t have insurance or your plan does not cover physical therapy, you can still receive care, but you’ll need to pay out of pocket. Prices vary by location, clinic, and service, but an average session can range from $75 to $250. Some clinics offer discounts for self-paying clients or provide payment plans to make therapy more affordable.

It’s worth discussing your financial situation with the clinic up front. Some may work with you to create a budget-friendly plan. You can also look into community clinics, local universities with physical therapy programs, or nonprofit organizations that offer low-cost services.

Key Factors That Influence Physical Therapy Insurance Coverage:

Several factors determine whether your physical therapy sessions are covered and how much they cost.

Medical Necessity

which means the treatment must be essential for recovery or function improvement. Insurers typically do not cover therapy sessions that are considered maintenance, preventive, or elective.

Referral Requirements

Many insurance plans require a referral from your primary care physician or specialist. Skipping this step might result in denied claims, even if physical therapy is technically covered by your plan.

Prior Authorization

where the insurance company needs to review and approve your therapy plan before treatment begins. This step is designed to ensure that care is necessary and cost-effective but can delay the start of therapy if not handled promptly.

Network Status

of your physical therapist. Choosing an in-network provider reduces your out-of-pocket costs and ensures a smoother claims process. Out-of-network therapists may charge more, and your insurance might cover only a small portion or nothing at all.

Finally, your plan’s annual coverage limit can determine how many therapy visits are covered. Surpassing this limit often requires additional documentation or approval, and sometimes patients are left to pay out of pocket for extended care.

Tips for Maximizing Insurance Benefits for Physical Therapy:

To maximize your insurance benefits for physical therapy, start by reviewing your policy’s summary and contacting your provider with questions about referrals, visit limits, copays, and prior authorizations. Choose in-network therapists and confirm their status before booking. Keep records of all communications and authorizations. Ask your therapist to regularly update your treatment plan and submit documentation to ensure continued coverage.

What To Do If Your Insurance Denies Coverage?

Insurance companies may deny physical therapy coverage due to missing documentation or questions about medical necessity. If denied, you can appeal by requesting a detailed explanation and submitting updated documentation. You may also file a claim with secondary insurance or ask the clinic about discounted self-pay rates, financing, or charitable options.

FAQ’s:

1. Do most health insurance plans cover physical therapy?

Yes, most insurance plans in the U.S. cover physical therapy if it is deemed medically necessary. Coverage typically includes a limited number of visits per year and may require referrals and prior authorization.

2. What kind of insurance is best for covering physical therapy?

Employer-sponsored plans, Medicare, and private health insurance often include physical therapy benefits. The best plan is one that offers low out-of-pocket costs, covers a high number of sessions, and works with a wide network of therapists.

3. Do I need a doctor’s referral to get physical therapy covered?

In many cases, yes. A referral from your primary care doctor or specialist is often required to prove the medical necessity of therapy and qualify for insurance reimbursement.

4. How much does physical therapy cost with insurance?

The cost depends on your plan. You may pay a copay (e.g., $30 per visit), coinsurance (e.g., 20% of the cost), or nothing at all after meeting your deductible. Some plans have limits on the number of sessions per year.

5. Is physical therapy covered under Medicare?

Yes, Medicare Part B covers outpatient physical therapy when it is medically necessary. After meeting your deductible, you typically pay 20% of the approved cost unless you have a Medigap plan.

Final Thoughts:

Yes, health insurance can and often does cover physical therapy. However, the amount covered, the steps required for approval, and the number of sessions allowed can vary greatly depending on your specific plan. By understanding your insurance, getting the proper referrals, and working with in-network providers, you can minimize costs and get the therapy you need for recovery and wellness.

Read More: