Do I Need Pip Insurance If I Have Health Insurance – Protect Yourself With Pip!

When shopping for car insurance, you might come across something called Personal Injury Protection (PIP). If you already have health insurance, it’s natural to ask: Do I really need PIP insurance too?

The answer isn’t always simple. It depends on where you live, the kind of coverage your health plan offers, and how much financial protection you want after an accident.

In this article, we’ll explain what PIP insurance is, how it differs from health insurance, and whether it’s necessary if you already have medical coverage. We’ll also help you understand your state’s legal requirements and how to make the best decision based on your personal situation.

What Is PIP Insurance?

Personal Injury Protection (PIP) is a type of car insurance that covers medical expenses and other costs that arise from injuries in a car accident — no matter who caused the accident.

PIP is often referred to as “no-fault” insurance because it pays out benefits regardless of who was responsible. This means your PIP coverage can help you immediately after an accident, without waiting for investigations or lawsuits.

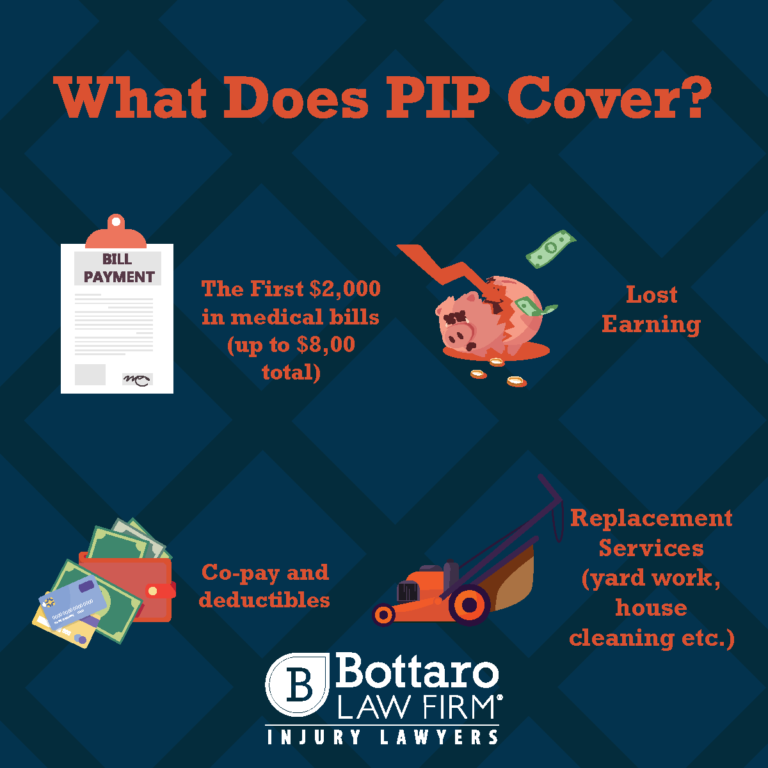

What Does PIP Cover?

PIP usually covers:

- Medical expenses (hospital visits, surgery, medication, rehab, etc.)

- Lost wages if you can’t work due to injuries

- Funeral expenses (in case of death)

- Essential services like childcare or household help while you recover

What Is Health Insurance?

Health insurance helps cover the cost of medical treatment and services. It’s not tied to your car or driving — it covers you for illnesses and injuries whether they’re from an accident or not.

Your health insurance may come from:

- Your employer (group plan)

- A private plan

- Government programs (like Medicare or Medicaid)

Health insurance usually has deductibles, co-pays, out-of-pocket limits, and provider networks.

Key Differences Between PIP and Health Insurance:

Here’s a side-by-side comparison of how PIP and health insurance differ:

| Feature | PIP Insurance | Health Insurance |

| Purpose | Covers accident-related injuries | Covers general health needs |

| Coverage Begins | Immediately after accident | After deductibles/co-pays are met |

| Pays for Lost Wages | Yes | No |

| Pays for Funeral Expenses | Yes | Rarely |

| Covers Passengers | Yes (if injured in your vehicle) | No |

| No-Fault Coverage | Yes | No (injury cause may affect coverage) |

| Tied to Auto Insurance | Yes | No |

Is PIP Required?

Whether you need PIP depends heavily on where you live.

Some states require PIP as part of their no-fault insurance laws, while others make it optional.

States That Require PIP

The following states usually require PIP coverage:

- Florida

- Michigan

- New York

- New Jersey

- Pennsylvania

- Massachusetts

- Hawaii

- Kentucky

- Utah

- Minnesota

- North Dakota

- Delaware

These states have no-fault laws, meaning your own insurance pays your medical costs after an accident, regardless of fault.

If you live in one of these states, you’re legally required to carry PIP coverage — even if you have health insurance.

Should You Still Get PIP If You Have Health Insurance?

Now let’s get to the main question: If you already have health insurance, do you still need PIP?

Here are some important points to consider.

1. Health Insurance May Not Cover Everything

While your health insurance covers medical care, it often doesn’t cover:

- Lost wages due to injury

- Help with chores while recovering

- Funeral costs

PIP covers these extras, making it a broader safety net after a car crash.

2. Health Insurance Has Out-of-Pocket Costs

Even with good health insurance, you might have to pay:

- A deductible before coverage starts

- Co-payments for doctor visits

- A portion of hospital or rehab costs

PIP can help pay these out-of-pocket costs, acting as secondary coverage to your health plan.

3. Quicker Payouts With PIP

PIP claims are processed faster than health insurance claims because they are part of your auto insurance and don’t require fault to be proven.

This can be helpful when you need quick access to funds after an accident.

Also Read: Is Yakult Good for Health – A Simple Guide to Understanding Its Benefits!

4. Health Insurance May Exclude Auto Accidents

Some health insurance plans may limit or exclude coverage for injuries resulting from car accidents — or require car insurance to pay first. In such cases, PIP is essential.

Check your policy’s fine print to see what’s covered.

When Might You Not Need PIP?

There are a few situations where you may decide PIP isn’t necessary:

- You live in a state where PIP is optional

- Your health insurance is strong (low deductible, broad coverage, good provider network)

- You have disability insurance that covers lost income

- You rarely drive or have a low risk of accidents

If you meet all of the above, you might be able to skip PIP — but weigh the risks carefully.

What Happens If You Decline PIP?

In states where PIP is optional, you may have to sign a waiver to decline coverage. But doing so could expose you to higher costs in the event of an accident.

Let’s look at a quick example:

Scenario 1 (With PIP):

- You’re in a car crash and break your leg

- PIP pays $10,000 for surgery + $2,000 in lost wages

Scenario 2 (No PIP):

- You rely solely on your health insurance

- You pay a $2,000 deductible + 20% co-insurance on a $10,000 bill = $4,000 out-of-pocket

- No help for lost wages

As you can see, having PIP could significantly reduce your financial burden.

Coordinating PIP and Health Insurance:

Some states and insurers let you choose which policy pays first — PIP or health insurance. This is called coordination of benefits.

Types of Coordination

- Health Primary: Health insurance pays first, PIP pays what’s left

- PIP Primary: PIP pays first, health insurance pays what’s left

Some people choose health primary to reduce their car insurance premium — but remember, this could delay treatment or create gaps in coverage.

PIP Coverage Limits:

PIP coverage usually comes with limits — you choose the maximum amount your insurer will pay per person, per accident.

Common limits include:

- $2,500

- $5,000

- $10,000

- $25,000

Higher coverage means a higher premium but better protection. Balance your budget with your need for coverage.

What About MedPay?

Another related insurance option is Medical Payments Coverage (MedPay).

How is MedPay different from PIP?

- Covers only medical expenses

- Does not cover lost wages or services

- Usually optional

- Available in more states than PIP

If your state doesn’t offer PIP, MedPay might be a good alternative.

FAQ’s:

1. Does my state require it?

If your state mandates PIP, you must carry it—no exceptions. It’s a legal requirement in many no-fault states.

2. What’s included in my health insurance?

Review your plan for deductibles, co-pays, and exclusions.Make sure it covers auto-related injuries.

3. Can I afford to be out of work without pay?

If missing work would strain your finances, PIP helps. It covers lost wages during recovery.

4. Do I have other insurance like disability or life insurance?

Without disability or life coverage, PIP fills key gaps.It offers broader protection after an accident.

5. What’s my driving situation like?

Daily commutes or high mileage increase accident risks.In such cases, PIP provides added security.

Conclusion:

PIP insurance offers extra protection after a car accident by covering lost wages and services that health insurance doesn’t. It’s required in some states, and even when optional, it can fill important gaps in coverage. If your health plan has limits or high out-of-pocket costs, having PIP is often a smart choice.

Read More: