Does Health Insurance Cover Eye Exams – Everything You Need to Know!

Eye health is an essential component of overall well-being. Regular eye exams not only determine if you need glasses or contact lenses but can also detect early signs of serious health conditions like glaucoma, diabetes, and high blood pressure. Yet, many Americans often wonder: Does health insurance cover eye exams? This question becomes especially relevant as healthcare costs continue to rise.

In this comprehensive guide, we’ll dive into all the details you need to know, from insurance types to coverage breakdowns and tips for maximizing your benefits.

Understanding Eye Exam Coverage:

Health Insurance vs. Vision Insurance

When discussing insurance coverage for eye exams, it’s crucial to differentiate between health insurance and vision insurance:

- Health Insurance: Typically focuses on medical care, hospital visits, surgeries, and chronic disease management. Coverage for routine eye exams may be limited or excluded.

- Vision Insurance: Specifically designed to cover eye care services, including routine exams, corrective lenses, and sometimes even surgical procedures like LASIK.

Why This Distinction Matters

Many people mistakenly assume that their general health insurance automatically covers all aspects of eye care. However, unless specified, most health insurance plans do not cover routine vision services.

When Does Health Insurance Cover Eye Exams?

Covered Scenarios Under Health Insurance

Your regular health insurance might cover eye exams in specific situations, particularly when the exam is deemed medically necessary:

- Eye Injuries: If you experience trauma to the eye.

- Diseases or Conditions: Such as glaucoma, cataracts, macular degeneration, or diabetic retinopathy.

- Symptoms Requiring Diagnosis: Blurry vision, double vision, eye pain, or flashes of light.

- Post-Surgical Follow-Ups: If you’ve undergone eye surgery for medical reasons.

What Health Insurance Usually Excludes

- Routine eye exams for vision correction.

- Contact lens fitting.

- Glasses and frames.

- LASIK or cosmetic eye surgeries (unless medically necessary).

Can I buy standalone vision insurance?

Yes, you can buy standalone vision insurance even if you don’t have health insurance. These plans cover routine eye exams, glasses, and contact lenses. Many private companies offer affordable monthly options.

The Role of Vision Insurance:

What Vision Insurance Typically Covers

If your primary concern is regular eye exams and vision correction, vision insurance can fill the gap left by standard health insurance. Vision plans generally include:

- Annual eye exams.

- Prescription glasses and lenses.

- Contact lenses.

- Discounts on corrective surgery (LASIK).

- Frames and lens enhancements.

Popular Vision Insurance Providers in the USA

- VSP (Vision Service Plan)

- EyeMed

- Davis Vision

- Humana Vision

- UnitedHealthcare Vision

How Much Does an Eye Exam Cost Without Insurance?

For those without vision insurance or comprehensive health insurance coverage, the cost of an eye exam can vary:

- Basic eye exam: $50 to $250

- Comprehensive exam with dilation and additional tests: $100 to $400

- Specialized tests (for diseases): Up to $500 or more

These costs emphasize why having appropriate insurance coverage is so valuable.

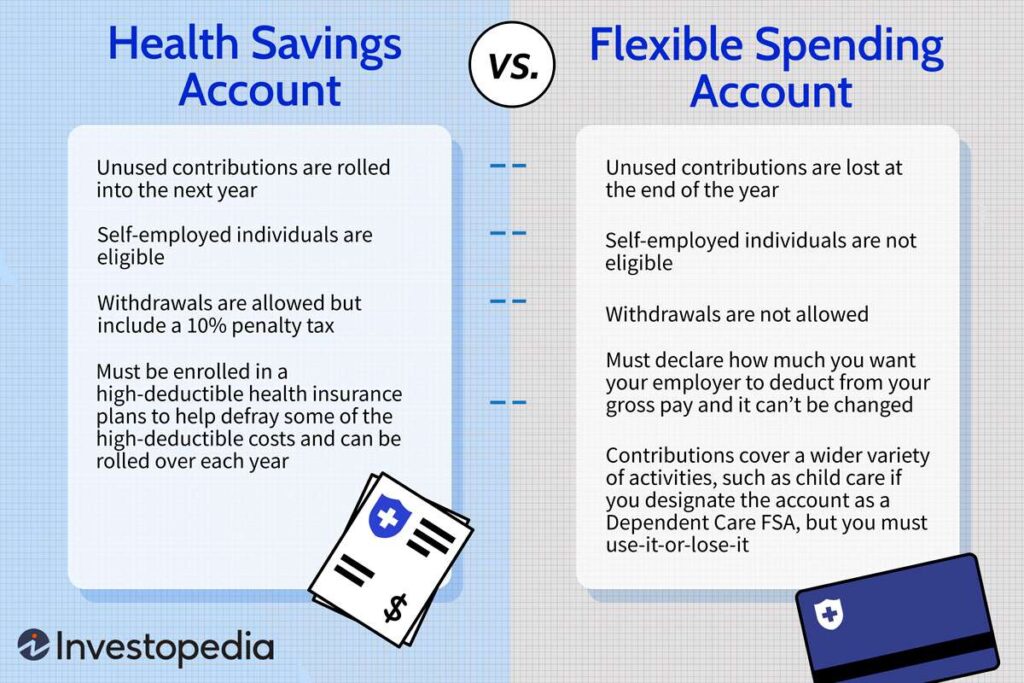

Can I use HSA or FSA funds for eye exams?

Yes, you can use HSA (Health Savings Account) or FSA (Flexible Spending Account) funds to pay for eye exams. These accounts let you use pre-tax money for qualified medical expenses, including vision care. You can also use them for glasses, contact lenses, and some eye surgeries. Just be sure to keep your receipts for tax records.

Also Read: Is Nursing a Health Science – A Comprehensive Exploration!

Medicare and Medicaid Coverage for Eye Exams:

Medicare

- Part A (Hospital Insurance): Rarely covers routine eye exams.

- Part B (Medical Insurance): Covers eye exams if you have a high risk of glaucoma, diabetic retinopathy, or macular degeneration.

- Medicare Advantage Plans (Part C): Many offer additional vision coverage, including routine eye exams.

Medicaid

Medicaid coverage varies by state but often includes:

- Children: Typically covered under Early and Periodic Screening, Diagnostic, and Treatment (EPSDT) benefits.

- Adults: Some states offer limited vision benefits; others may offer comprehensive vision care.

Employer-Sponsored Vision Insurance Plans:

Many employers offer vision insurance as part of their benefits package. These plans typically include:

- Annual or bi-annual eye exams.

- Glasses or contact lens allowances.

- Discounts on surgical procedures.

- Network of approved eye care providers.

Advantages of Employer-Sponsored Plans

- Group rates are often more affordable.

- Broader coverage options.

- Lower out-of-pocket expenses.

How often should I get an eye exam?

Adults should get a comprehensive eye exam every 1 to 2 years, depending on their age, vision, and overall health. People with glasses or contact lenses, diabetes, or a family history of eye diseases should go yearly. After age 60, yearly exams are strongly recommended to detect age-related conditions like cataracts or glaucoma. Early detection helps protect long-term vision.

Alternative Options for Eye Exam Coverage:

Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs)

- Both FSAs and HSAs can be used to pay for vision-related expenses, including eye exams, glasses, and contact lenses.

- Contributions to these accounts are tax-free, providing additional financial relief.

Retail Vision Centers and Discount Programs

Many large retailers offer affordable eye exams without insurance:

- Walmart Vision Centers

- Costco Optical

- Target Optical

- Sam’s Club Optical

Additionally, discount programs such as AARP Vision Discounts or AAA Vision Discounts can help reduce costs.

Tips for Maximizing Your Eye Care Benefits:

1. Review Your Insurance Policy

Carefully read your policy documents to understand:

- Covered services

- Network providers

- Co-pays and deductibles

2. Use In-Network Providers

- Staying within your insurance provider’s network can significantly reduce out-of-pocket costs.

3. Schedule Regular Eye Exams

- Don’t wait for vision problems to arise. Early detection can prevent serious complications.

4. Take Advantage of Preventive Care

- Some plans offer additional preventive care services at no extra cost.

5. Combine Vision and Medical Benefits

- If you have both health and vision insurance, coordinate coverage to minimize expenses.

The Importance of Regular Eye Exams:

Routine eye exams are not just about vision correction. They can:

- Detect early signs of diabetes, hypertension, and high cholesterol.

- Prevent permanent vision loss from glaucoma or macular degeneration.

- Monitor overall eye health and spot developing conditions early.

FAQs:

1. Does Obamacare (ACA plans) cover eye exams?

Most ACA plans include vision coverage for children but may not cover routine eye exams for adults. However, some plans offer optional vision add-ons.

2. Does Medicare cover routine eye exams?

Medicare generally does not cover routine eye exams but does cover medically necessary exams related to specific conditions like glaucoma or diabetic retinopathy.

3. What’s the difference between an eye exam and a vision screening?

A vision screening is a basic test to check visual acuity, often done at schools or health fairs. An eye exam is a comprehensive evaluation by an eye care professional.

4. Do employer-sponsored health plans typically include vision coverage?

Some employer plans include vision coverage as a separate benefit or offer it as an optional add-on.

5. Is LASIK surgery covered by health insurance?

Generally, LASIK is considered elective and not covered by health insurance. Some vision plans offer discounts, but full coverage is rare.

6. Are pediatric eye exams covered by insurance?

Yes, under the Affordable Care Act, vision coverage for children is considered an essential health benefit.

7. What happens if I skip routine eye exams?

Skipping exams increases the risk of undiagnosed vision problems and serious health issues that could lead to permanent vision loss or systemic health complications.

Closing Thoughts:

While traditional health insurance may not always cover routine eye exams, understanding your options and exploring supplemental vision insurance can help ensure comprehensive eye care. With many affordable plans and employer-sponsored options available, prioritizing your eye health is both accessible and financially manageable. Early detection, regular screenings, and proper coverage will protect not just your vision but your overall health for years to come.

Read More: